How much does h&r block charge?

The purpose of H and R Block is that H&R Block provides tax advice only through Peace of Mind Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. Power of Attorney required.

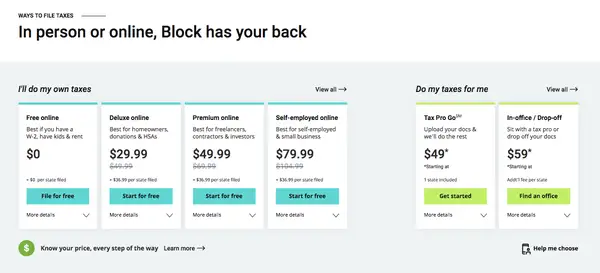

If youu have a question that “Is H&R Block really free?” the answer is Yes, the service is free for both federal and state if you are filing a simple tax return. It covers unemployment income, retirement income, W-2 income, and interest and dividend income.

Why is H&R Block charging so much?

H&R Block charging so much because there could be two reasons. There are company HR Blocks, and Franchise HR Blocks. Company uses the prices set by corporate headquarters, but franchise can set their own pricing. Also, HR Blocks pricing changed this year to make the price more transparent, so there was no fee surprise at the end of tax prep.

According to the latest survey by the National Society of Accountants (NSA), the average tax preparation fee for an itemized Form 1040 with Schedule A and a state tax return is $323, and $220 if non-itemized. By comparison, if you have a moderately simple tax return with itemized deductions, you can file using the H&R Block do-it-yourself online service for $69.00 for federal and $44.99. For more complex tax returns, the company has other product offerings with prices on their official website.

W2 Form:

Single W2 (0 dependent) – $135.00

Joint W2 (0 dependent) – $135.00

1099 Form:

In-Store Self Employed 1099 (0 dependent) – $350.00

Do-It-Yourself Self Employed Online 1099 (0 dependent) – $109.99 (+ $44.99 per state filed)

Click here to see rest of H&R Block prices.

Naturally, the prices reported on this website may not be current, and may not apply to all locations of a given business brand. To obtain current pricing, contact the individual business location of interest to you.

You can expect to pay more if you have any of the following:

- Real estate taxes or home mortgage interest deductions

- Small business expenses that may qualify for deductions

- Rental income and expenses that may qualify for deductions

- Investment income on stocks, bonds, or cryptocurrency

How it works?