How Much Does HR Block Cost?

In this article we will explain about h&r block cost. H&R Block is one of the most popular tax software providers in the US and Personal Finance Insider named it the best free-file tax software of 2022. H&R easy-to-use online interface and expert support may be more convenient than going into a physical office during the pandemic. Its rates vary widely depending on your tax situation. Below, you’ll find additional details on each option.

- TurboTax and H&R Block offer various tiers of tax prep programs, based on the complexity of your tax situation.

- As of the 2021 tax period, Jackson Hewitt has opted for a one-size-fits-all package.

- H&R Block and TurboTax have free editions for simple tax returns only.

- The most expensive programs for more complex tax situations range from $50 (Jackson Hewitt) to $95 (H&R Block) and $90 (TurboTax).

How Much Does H&R Block Cost?

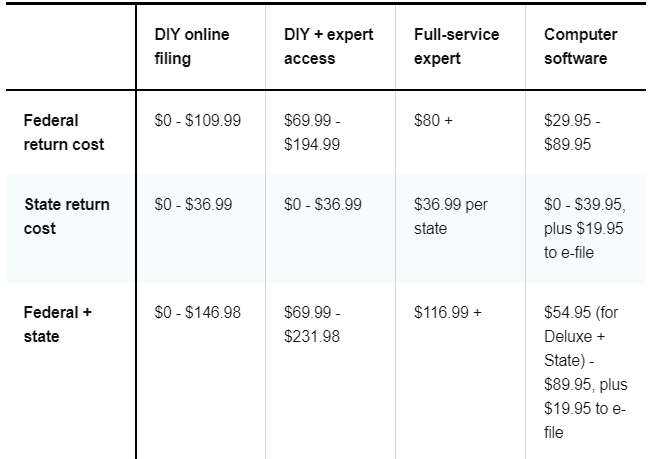

H&R Block allows its clients to complete their own taxes online and offers a 35% discount for doing so. With H&R Block online software, you’re going to be able to claim every credit and deduction available to you. There are 4 online versions to choose from:

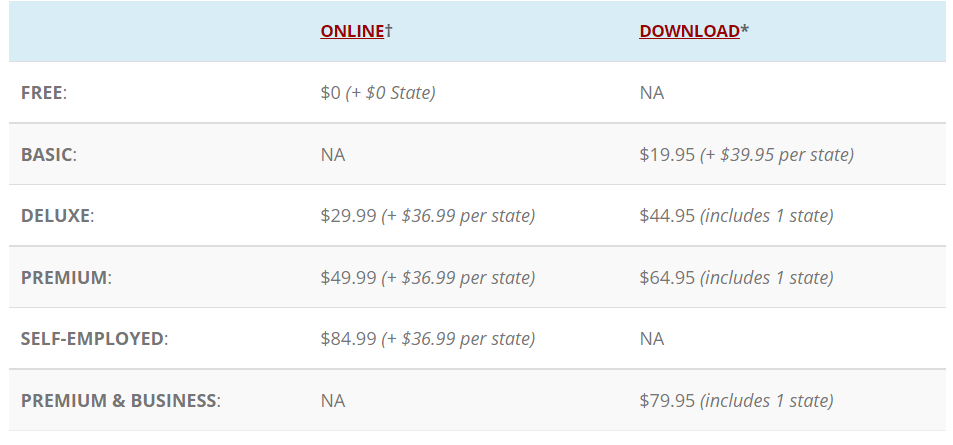

1. Basic – Best for simple tax situations Free. Free online edition should suit you just fine if you have only W-2 income and/or unemployment income, and you rent your home. You can use this edition to add dependent info too. A free state return is included.

2. Deluxe – Best for homeowners $49.99. The Deluxe online plan, H&R Block’s next tier, is designed for homeowners, investors, those with retirement income, and those who’ve made contributions to health savings accounts. It offers support for stock and other investment sales, and it also covers home-mortgage interest deductions, charitable giving deductions, and all other itemized deductions if you don’t want to claim the standard deduction. It costs $50, and that includes support for most Form 1099s, free tech support, and a “drag and drop” feature that permits the free importing of current and past-year data. Plan to spend an extra $45 for each state return filed.

3. Premium – Best for self-employed or rental property owners $69.99. Premium online tier, coming in at $65, including one free state return; additional state returns are $40. This should meet the needs of freelancers and independent contractors who may have more than one 1099 but with deductible business expenses of less than $5,000, and it also accommodates investors who own rental property or have sold stock.

4. Business – Best for small business owners $109.99. Business online edition to serve the more than 60 million freelancers, independent contractors, and other self-employed taxpayers, including the estimated over three in 10 Americans who rely on gig work for their primary income.

H&R Block Prices are increase and tax are allowed because of various reasons. for more details about HR block then click here….

H&R Block Prices:

H&R Block Prices are increase and tax are allowed because of various reasons. H&R Block is the world’s largest consumer tax services provider. Based in Kansas City, MO, the company offers in-person and online tax preparation services through around 12,000 owned and franchised retail locations in all 50 states, Puerto Rico and other U.S. territories, including U.S. military bases around the world. Table of Contents show also provides digital solutions for those who want to do their own tax returns on their own. H&R Block prices are reasonable when compared with the hourly rates that professional CPAs regularly charge for similar services.