Self-assessment tax is the balance tax calculated and paid after deducting the TDS and advance tax paid in the financial year. For a more straightforward understanding, if during the assessment year, it is found that an assessee (a person liable to pay tax) has additional tax liabilities after factoring in the TDS and advance tax paid in the preceding year, they need to pay SAT to the government. The return filing will not consider complete without processing the self-assessment login you don’t know how to do it, that’s why we’ll help you through this article.

How to Register for Self-Assessment Income Tax?

There are different ways to register if you’re self-employed or not self-employed but need to declare income, or if you’re in a partnership.

Whenever you’ve register, you’ll sent a Unique Taxpayer Reference (UTR). If you want to submit your Self Assessment form online, you’ll then need to set up a Government Gateway account. To do this, follow the instructions in the letter containing your UTR.

When you’ve set up the account, you’ll get an activation code in the post. You’ll then need to complete the set-up of your Gateway account. If you’ve submitted Self Assessment tax returns before, you’ll need your old UTR to register and set up the account.

It’s best to make sure you can access your Gateway account before you try to submit your Self Assessment. This saves time if, for any reason, you can’t log in.

Tip: The deadline for registration is the 5th of October in your business’ second tax year. Don’t miss it!

What information need to fill in a Self Assessment?

- Ten-digit Unique Taxpayer Reference (UTR)

- Your National Insurance number

- Details of your untaxed income from the tax year, including income from self-employment, dividends, and interest on shares

- Records of any expenses relating to self-employment

- Any contributions to charity or pensions that might be eligible for tax relief

- P60 or other records showing how much income you received that you’ve already paid tax on.

It’s also a good idea to read the relevant HMRC help sheets, particularly on the extra sections (called supplementary pages) that relate to why you’re filling in the Self Assessment tax return.

How to Login For Self Assessment?

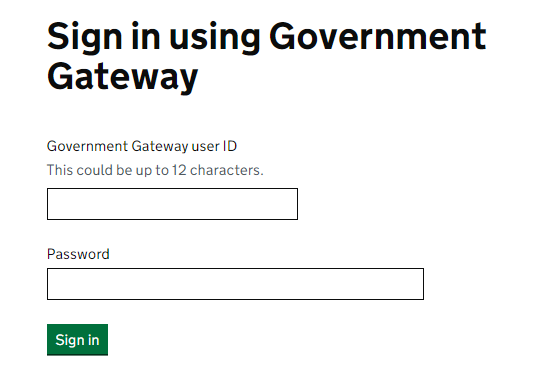

For self-assessment login you need to follow the below-mentioned steps:-

- Search for the Self Assessment login site on your web browser.

- Now, enter the Government Gateway user ID and password.

- Tap the Sign in button.